We take a closer look at some of the most important construction industry trends to prepare for in 2022.

Suffice to say that 2020 and 2021 were turbulent years for the UK’s construction industry. Unsurprisingly, the ongoing pandemic has been the great disruptor, causing a chain reaction of events that include material shortages, a labour squeeze and shipping delays, among others.

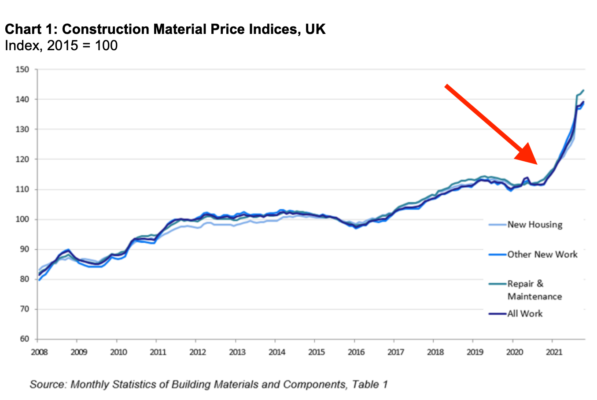

A case in point: a BEIS report shows that raw material costs surged every month between September 2020 and September 2021, while building work prices in October 2021 rose by nearly 25% year-over-year.

Image from the Department for Business, Energy & Industrial Strategy

Image from the Department for Business, Energy & Industrial Strategy

The good news is that the industry showed signs of recovery as 2021 wound down. For instance, the number of construction firms reporting supplier delays fell from 47% in November to 35% in December.

Related Reading: Ten Issues That Will Affect Construction Supply Chains In 2022

However, things are far from stable, and construction companies and builders should be aware of the most important construction industry trends that will shape the industry in 2022 and beyond.

We take a closer look at eight of these developments below.

What Construction Industry Trends Will Shake Up 2022?

1. Soaring Inflation Could Slow Down Recovery

Soaring inflation across the British economy will likely exacerbate construction supply chain disruptions. Already, inflationary pressures have caused a surge in energy prices, which, in turn, could lead material prices—particularly those in energy-intensive sectors like steel, cement and concrete—to rise even further.

In February, British Steel, the country’s second-largest steelmaker, was among several companies to increase prices due to rising wholesale energy prices. The company raised prices by 25% (£250 per tonne) for all new orders — the highest one-off increase in its history. Financial Times also reports that building materials firm Tarmac published energy surcharges on certain materials.

“Curbing inflation will continue to be a big issue for building firms who will be nervous about securing continuing supply and offsetting price rises to improve business margins,” explains Duncan Brock, group director at the Chartered Institute of Procurement & Supply

(CIPS), in a story for The Independent.

2. Building Safety Bill Sets New Safety Standards For In-Scope Buildings

As the Building Safety Bill makes its way through Parliament, businesses will soon have to adapt to what the government calls are “the biggest changes to building safety regulations in a generation.”

The bill, recognised as the primary legislative action following the Grenfell Tower Fire in 2017, includes critical reforms that modify how certain structures will be built, maintained and made safer. It will impact all contractors, developers and organisations involved in the construction and design of in-scope buildings — defined as “higher-risk buildings” in England that are:

- At least 18 metres in height or has at least seven storeys; and

- Contains at least two residential units.

The bill also creates a Building Safety Regulator embedded within HSE to oversee the enforcement of a new, stricter safety regime for in-scope buildings.

Related Reading: What Is Safety Culture? Your Guide To Positive Safety Culture

3. The Ongoing Worker Shortage Will Continue

The shortage in lorry drivers dominated news headlines in 2021, as the effects of COVID-19 and Brexit clashed to create a supply chain crisis. However, this is just one aspect of a larger labour squeeze encompassing many industrial sectors, making it one of the most important construction industry trends to brace for this year.

The findings of the 2021 House Builders’ Survey by the Federation of Master Builders (FMB) show that over half (53%) of its members — small and medium-sized building contractors — had difficulty finding workers to build homes last year. For workers, on the other hand, it’s happy days — Financial Times reports that bricklayers now command a daily rate of £220 (up from £180 pre-pandemic), mainly due to a shortage of construction professionals.

Image from Financial Times

Whilst the government is taking steps to mitigate this workforce crisis, it’s unlikely to be resolved entirely this year.

Related Reading: What Trades Are In Demand In The UK?

4. In-Person Construction Trade Shows And Events Are Back

After two years of mostly virtual events, in-person tradeshows and conventions are officially back in 2022. This year, one of the major UK construction events was UK Construction Week London in May, with part two happening in Birmingham in October.

This October, you also have bauma — the world’s largest construction machinery trade show happening in Munich, Germany. The eagerly-awaited triennial event is the first since 2019, where it welcomed a record-breaking 3,990 exhibitors and nearly 630,000 visitors.

5. Shipping And Storage Costs To Stay High

Bad news for construction firms and builders: increases in shipping and logistics prices are expected to continue this year.

The Wall Street Journal reports that transportation and distribution providers plan to hike contract rates, further exacerbating inflationary pressures. In December 2021, the cost of shipping a 40-foot container from Shanghai to Los Angeles, for example, was 75% higher than the same period the previous year. Meanwhile, the same shipment, but from Asia to northern Europe, now costs $14,483 — 10 times higher than pre-pandemic levels, according to a report by The Guardian.

The cost of goods storage is also expected to rise quickly as warehouse and facility owners are set to hike prices for expiring leases that had allowed businesses to avoid rental increases in 2021.

6. BIM Implementation To Rise Even Further

While many construction processes have undergone a digital transformation over the years, the advent of building information modelling (BIM) is easily one of the most transformative construction industry trends in recent years. With its focus on collaborative design and construction workflows and real-time project visibility, BIM software enables construction companies to visualise projects, lower costs and speed up construction timelines. In a nutshell, it makes construction processes more efficient and supports sharing information between designers and builders.

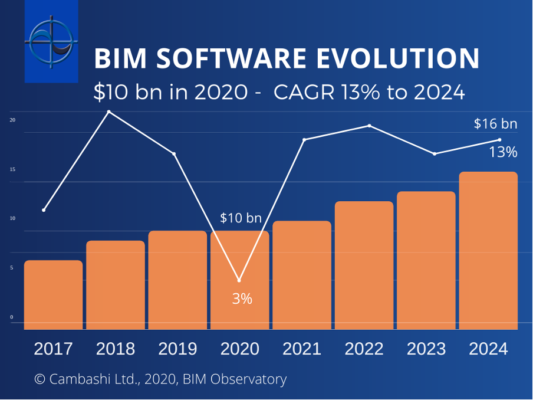

Image from Cambashi

According to a report by global market research firm Cambashi, the global BIM software market will reach $13 billion in value by 2024, representing a 13% compound annual growth rate (CAGR) from 2020 to 2024.

7. Green Construction Now Backed By Law

Green construction practices are shaping up to become the standard for buildings, homes and other structures, thanks largely to recent rules and legislation.

Passed into law in November 2021, the Environmental Act 2021 has been lauded as a turning point in the fight against climate change. The law establishes a post-Brexit framework for environmental governance. It provides a roadmap for future environmental standards and legislation, covering enforceable targets for air and water quality, biodiversity and waste management.

Meanwhile, companies bidding on government contracts with a value of over £5 million will now be required to demonstrate their commitment to achieving zero emissions by 2050. In the rules outlined in Public Policy Note 06/21, in-scope organisations will need to furnish a carbon reduction plan indicating how they intend to reduce CO2 emissions by 80% in 2050.

These new rules are a timely reminder for contractors and builders to check their compliance with environmental standards through assessment schemes such as PAS 91 and the Common Assessment Standard

Related Reading: Environmental Certification: What Is It And Why Do You Need It?

8. COVID-19

Whilst the UK has ended COVID-19 restrictions, the pandemic continues to be a point of concern for the construction sector and the overall economy. According to data from the Office for National Statistics, an estimated one in every 50 people in England (around 1.13 million people) were thought to have had COVID-19.

There’s also no telling whether new variants, like Omicron, will lead to another surge in cases. In the interim, construction businesses will have to pay close attention to government guidance and take steps to maintain good hygiene in the workplace and job sites.

Be sure to follow the CHAS blog to stay on top of the latest developments in the construction industry. To improve the resilience of your construction supply chain and stay one step ahead of disruptions, sign up for CHAS Elite membership to achieve the Common Assessment Standard.

As the elite standard of risk management accreditation, the Common Assessment Standard covers 13 types of supply chain risks, allowing you to demonstrate compliance with health and safety, environmental and quality standards, among others.

Not sure where to start? Learn how the membership process works by reading our guide to joining CHAS.

Book a callback to learn more about our compliance and supply chain risk management services.

Request A Callback

By submitting this form you confirm you are happy to be contacted by CHAS in accordance with our Privacy Policy.