In 2024, risk management in the sector will be reshaped by advanced technologies, regulatory shifts, and the growing importance of environmental and social governance. These factors combine to set new paradigms in how risks are identified, assessed, and mitigated.

In 2023, the global energy sector experienced a period of recovery. While the effects of the energy crisis have waned throughout the year, energy markets continue to be tense and volatile. The ongoing Russian invasion of Ukraine, conflict in the Middle East and threats of a recession in both the United States and the United Kingdom combine to create an uncertain environment for the energy industry.

As we make our way into 2024, risk management in the energy sector will be a vital discipline, ensuring the stability, safety, and sustainability of organisations in the industry. In this guide, we take a closer look at the historical and modern landscapes of risk management and how these changes reflect a rise in technological and regulatory advancements and a shifting recognition of the energy industry’s broader social and environmental responsibilities.

By comparing and contrasting historical approaches with contemporary practices in managing risks, we can gain a deeper appreciation of the complex and dynamic nature of risk management in this ever-evolving sector.

What Is Risk Management In The Energy Sector?

Risk management in the energy sector encompasses identifying, assessing, and prioritising potential risks, followed by coordinated and economical application of resources to minimise, monitor, and control the probability or impact of unfortunate events. This process is crucial, as the implications of risks in this sector are far-reaching, affecting everything from environmental safety to global market dynamics.

Related Reading: 3 Examples Of Effective Risk Management Strategies

Historical Context Of Risk Management In Energy

Risk management was markedly rudimentary in the nascent stages of the energy industry, heavily reliant on manual processes and the limited technology of the times. This era was characterised by a more reactive than proactive approach, with risk mitigation strategies often formulated in response to incidents rather than in anticipation of them.

The formal study of risk management began in the post-World War II years and was initially associated with the financial industry and insurance. The foundation of modern forms of risk management emerged out of necessity — market insurance was simply too expensive and insufficient to protect against pure risk.

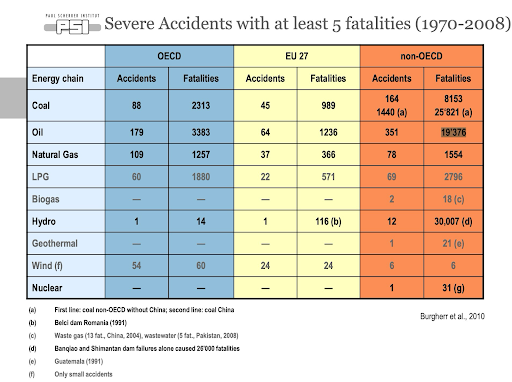

Source: Paul Scherrer Institut (PSI)

Throughout the 20th century, energy companies grappled with significant risks that had far-reaching impacts. A report by the Paul Scherrer Institut (PSI) has documented a significant number of fatalities in the energy sector, including nearly 24,000 global deaths in the oil industry alone between 1970 and 2008.

Accidents in the energy sector also led to long-lasting ecological damage — the immediate area around the Fukushima Daiichi Nuclear Power Plant, for example, remains inaccessible to the public.

Energy crises, spurred by geopolitical conflicts or resource shortages, have also led to significant economic and political repercussions worldwide. Most recently, the Russo-Ukrainian War triggered an energy crisis in the UK, leading to a cost-of-living crisis that continues to this day.

Related Reading: Proactive Risk Management For Utilities: Why Does It Matter?

Modern Energy Risk Management And The Rise Of New Technologies

Fast forward to today, and risk management has become a top priority of nearly every organisation in the energy sector.

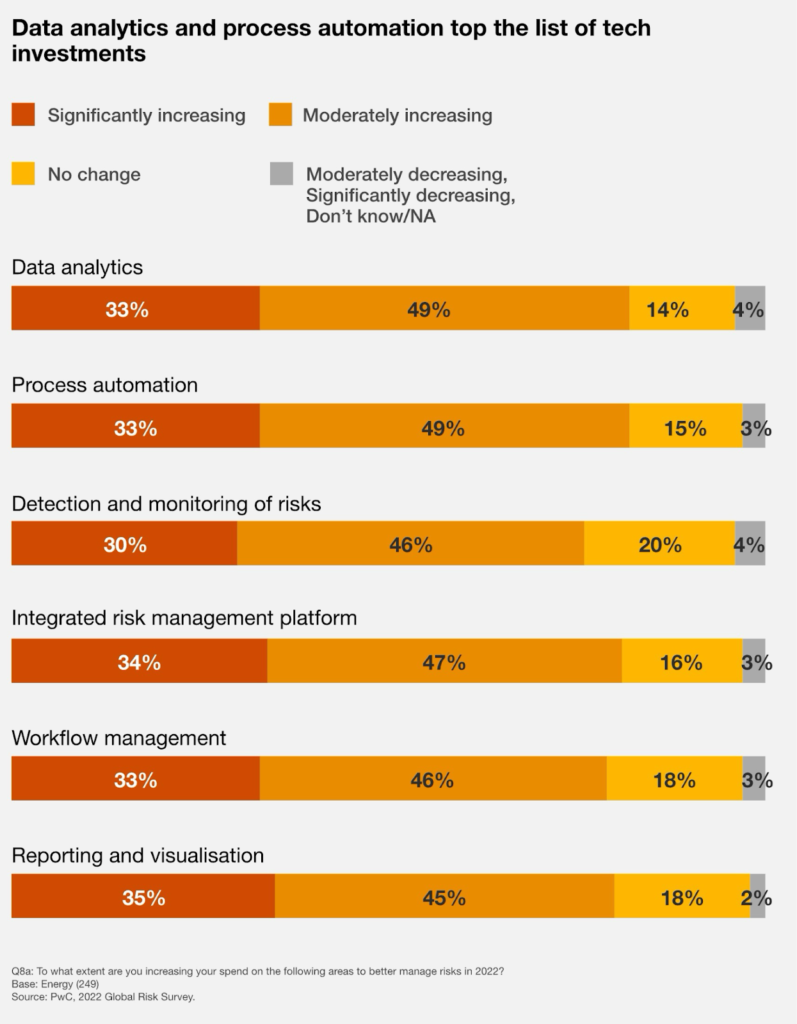

A 2022 report by PwC found that energy companies are ramping up investments in various facets of risk management technology, placing particular emphasis on process automation. These enterprises are increasing spending on process automation (82%) and data analytics (82%). Other priorities include adopting integrated risk management platforms as well as data visualisation and reporting tools.

Source: PwC

The advent of technological advancements has been a key factor in making risk management more accessible to energy companies of all sizes. Innovations such as digitalisation and data analytics have revolutionised how risks are identified, analysed, and mitigated. These technologies enable a more proactive and predictive approach, allowing for the anticipation of potential issues before they escalate into critical problems.

One significant example of technology mitigating specific risks is the use of sensor technology in monitoring equipment and infrastructure. Sensors can provide real-time data on the condition of machinery, alerting to any signs of wear or malfunction before they lead to accidents or breakdowns. Similarly, Geographic Information Systems (GIS) are used to identify environmental risks, like the proximity of industrial activities to sensitive ecological areas, enabling better planning and risk aversion strategies.

The Relationship Between Energy Risk Management And Regulatory Changes

In the UK, approaches to risk management in the energy sector have experienced significant transformation due to pivotal regulatory milestones emphasising safety, environmental sustainability, and market efficiency.

Noteworthy among these are the UK Climate Change Act of 2008, which set legally binding emission reduction targets, and the Energy Act of 2013, which aimed to deliver secure, affordable, and low-carbon energy. These regulations reflect the UK’s commitment to transitioning towards more sustainable energy practices.

Companies in the energy industry also have to be mindful of new and existing health and safety legislation, the most important being the Health and Safety at Work etc. Act 1974 — considered the centrepiece of all occupational health and safety regulations in Great Britain.

The impact of these regulations on operational and financial risk management is substantial. Energy companies in the UK are required to invest significantly in compliance infrastructure, which often entails revamping existing processes and systems. The financial implications are considerable, with non-compliance leading to heavy fines and reputational damage.

Additionally, the evolving nature of these regulations necessitates constant vigilance and adaptability, making compliance an ongoing and dynamic aspect of risk management in the UK energy industry. This environment underscores the importance of robust compliance frameworks and strategic planning to navigate the regulatory landscape effectively.

Related Reading: What Health And Safety Legislation Should All Employers Know About?

The Role Of Environmental And Social Governance (ESG) In Energy Risk Management

The concept of Environmental and Social Governance (ESG) has rapidly emerged as a key component in the risk management strategies of energy companies. ESG criteria focus on a company’s collective conscientiousness for social and environmental factors, extending beyond traditional financial metrics. Increasingly, investors, customers, and regulatory bodies are using ESG as a yardstick to evaluate companies’ performances and sustainability practices.

Related Reading: What Is ESG, And Why Is It Important?

There are several case examples where ESG considerations have driven significant changes in the industry. For instance, the shift towards renewable energy sources like wind and solar power is partly driven by ESG factors, reflecting a response to climate change concerns and societal expectations for sustainable practices. Additionally, companies are increasingly transparent about their carbon footprints and are investing in carbon capture and storage technologies.

In November 2023, the UK Government announced plans to invest £960 million into green industries to accelerate manufacturing in net zero sectors, including offshore wind energy, renewable energy networks, carbon capture, usage and storage, and hydrogen and nuclear energy.

Related Reading: Recent Developments In Global Environmental, Social, Governance (ESG) Regulations

Follow CHAS Insights to keep up with the latest insights and best practices on risk management in the energy sector. You can also get more hands-on assistance in managing sustainability risks in your supply chain with CHAS Social Sustainability. Veriforce CHAS can help you benchmark your supply chains against a range of sustainability criteria to drive process improvements.

Are You Ready To Be A CHAS Client?

Sign up for FREE today or learn more about our client services by scheduling a callback with one of our friendly CHAS advisors.